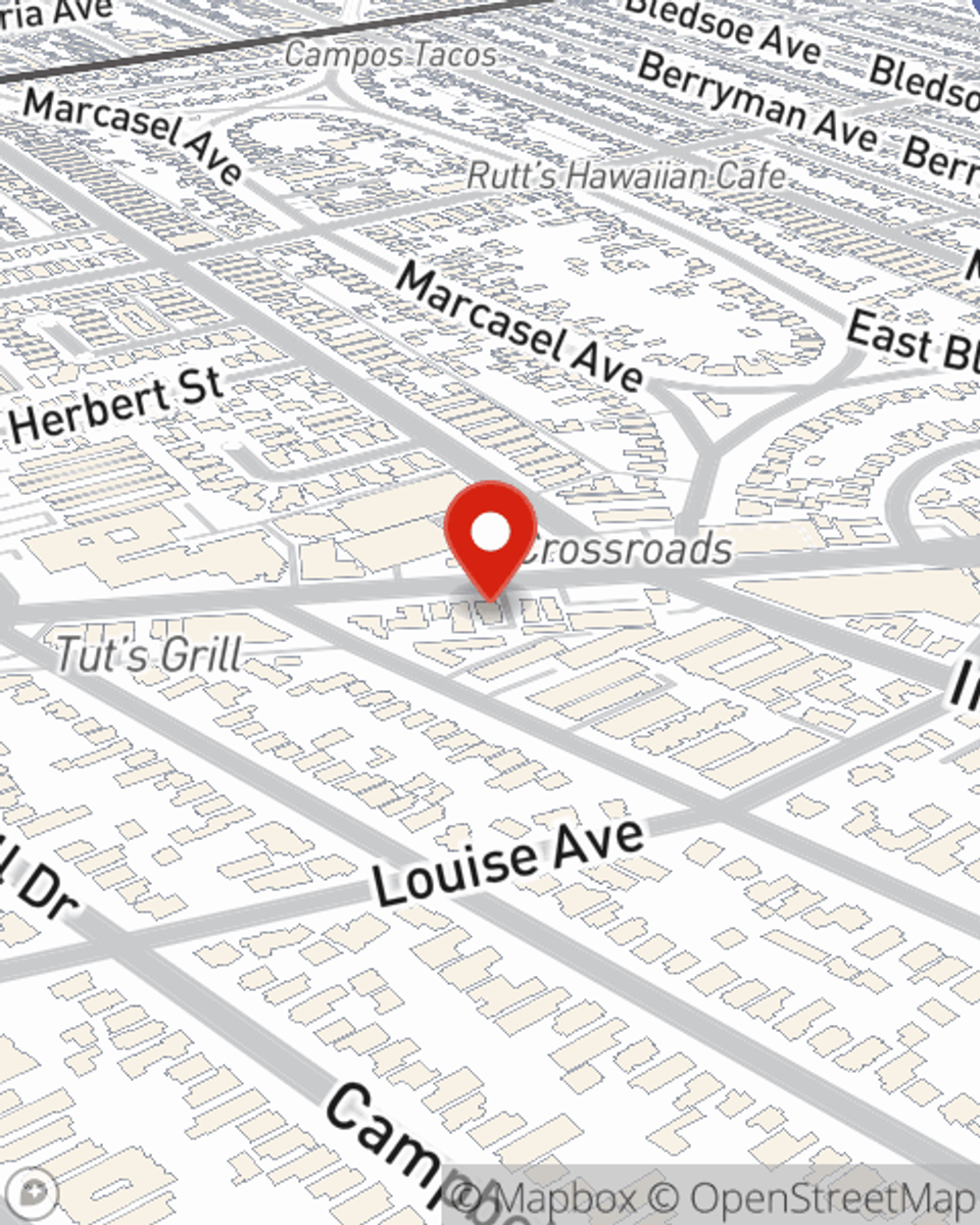

Life Insurance in and around Los Angeles

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- LA County

- Los Angeles

- Santa Monica

- Venice

- Brentwood

- Pacific Palisades

- Marina Del Rey

- Mar Vista

- Playa Del Rey

- Playa Vista

- Westchester

- Culver City

- West Los Angeles

- Westwood

- Beverly Wood

- Beverly Hills

- South Bay

- El Segundo

- Hancock Park

- California

- Arizona

- Nevada

It's Never Too Soon For Life Insurance

State Farm understands your desire to help provide for your loved ones after you pass. That's why we offer outstanding Life insurance coverage options and caring reliable service to help you choose a policy that fits your needs.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Their Future Is Safe With State Farm

When it comes to choosing how much coverage you need, State Farm can help. Agent Paul Major can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include how old you are, your health status, and sometimes even gender. By being aware of these elements, your agent can help make sure that you get an appropriate policy for you and your loved ones based on your unique situation and needs.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can be helpful to cover final expenses, such as medical bills or funeral costs, without overwhelming your loved ones. Contact your local State Farm agent Paul Major for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Paul at (310) 482-3990 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.